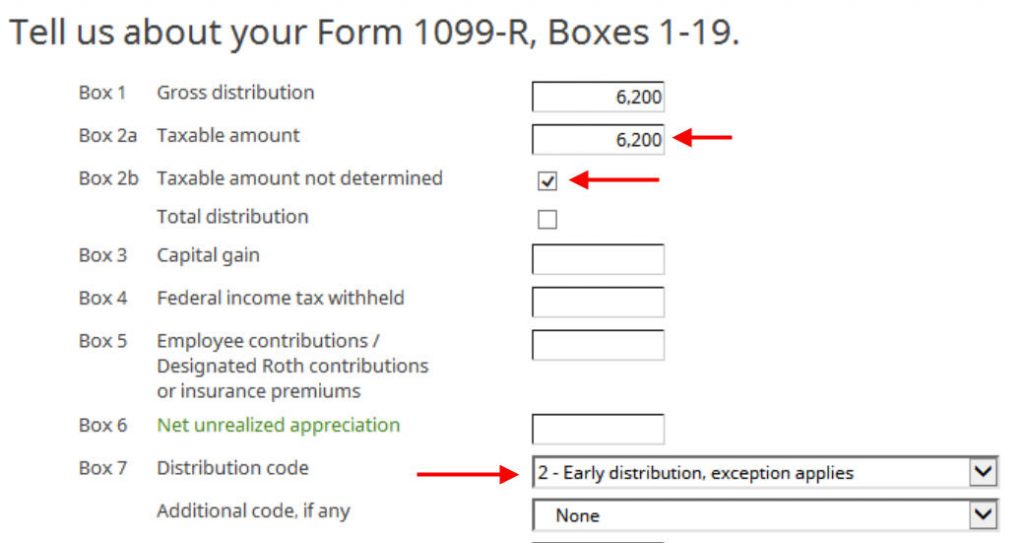

Solved: Have Non-Deductible IRA basis from 2020, converted to Roth in 2021 (backdoor Roth). How to enter this in Turbo Tax?

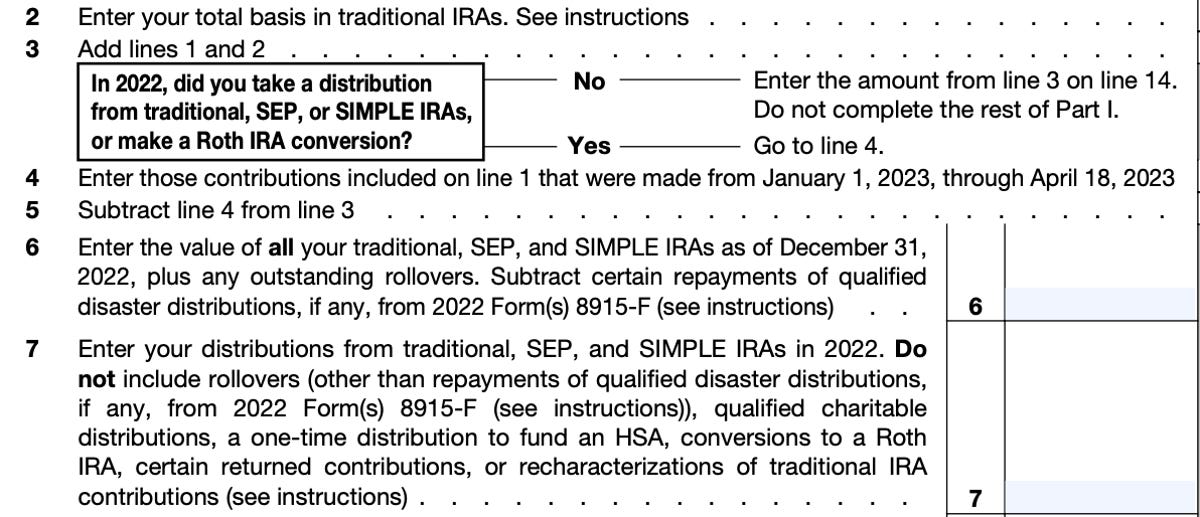

Publication 590, Individual Retirement Arrangements (IRAs); Chapter 1 - Traditional IRAs, Are Distributions Taxable?

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)